SMM July 7 News:

Persistent procurement by leading rare earth enterprises, coupled with market rumors suggesting potential production halts at some rare earth companies, has heightened expectations for oxide production cuts. Additionally, magnetic material enterprises' anticipation of demand recovery by month-end has intensified. On July 7, prices rose across most segments of the rare earth industry chain—from ore, oxides, and rare earth metals to NdFeB blanks and NdFeB scrap. Notably, Pr-Nd oxide and dysprosium oxide recorded three consecutive days of gains, while terbium oxide extended its rally to four days.

Price Increases Observed Across Multiple Rare Earth Industry Chain Segments

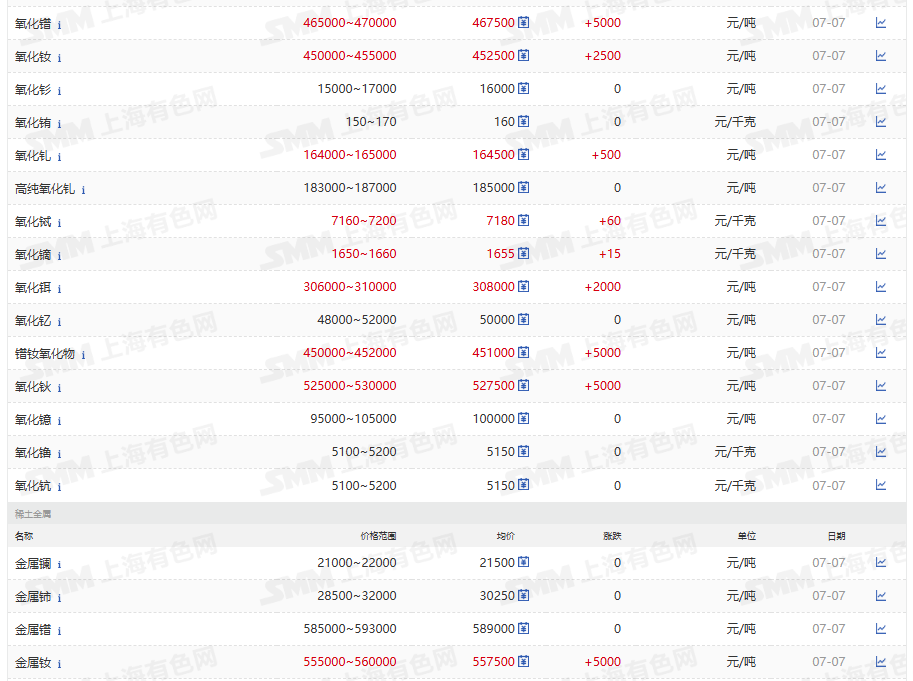

》Click to View SMM Rare Earth Spot Prices

》Subscribe to View SMM Metal Spot Historical Price Trends

On July 7, rare earth industry chain prices showed significant increases. In the oxide market, Pr-Nd oxide rose to 450,000-452,000 yuan/mt, dysprosium oxide climbed to 1.65-1.66 million yuan/mt, terbium oxide advanced to 7.16-7.2 million yuan/mt, and gadolinium oxide edged up to 164,000-165,000 yuan/mt. Holmium oxide increased to 525,000-530,000 yuan/mt. In the metal market, Pr-Nd alloy rose to 550,000-555,000 yuan/mt, dysprosium-iron alloy gained to 1.59-1.61 million yuan/mt, terbium metal surged to 8.85-8.9 million yuan/mt, and gadolinium-iron alloy moved up to 158,000-160,000 yuan/mt.

Notably, sustained procurement by major enterprises and market rumors about potential production cuts at some separation plants—combined with magnetic material enterprises' growing optimism about late-July demand recovery—have collectively supported rare earth prices. As of July 7, Pr-Nd oxide and dysprosium oxide had risen for three consecutive trading days, while terbium oxide extended its rally to four days.

Outlook

For the rare earth market outlook, continued procurement by major enterprises has significantly boosted market confidence. Concurrently, frequent tender purchases by large magnetic material enterprises are expected to provide strong price support. Furthermore, market speculation about potential supply constraints at regional separation plants, if realized, may further tighten oxide availability. The interplay between supply-side contraction expectations and rigid procurement demand is projected to reinforce upward price momentum in the near term. However, with downstream end-user demand still in the traditional off-season and limited acceptance of high-priced materials—evidenced by only sporadic just-in-time procurement transactions—the current "upstream refusal to budge on prices versus downstream wait-and-see" dynamic is likely to intensify back-and-forth negotiations between upstream and downstream players as prices climb. Currently, magnetic material enterprises have strong expectations for a demand recovery by the end of July, and this expectation has become an important variable in balancing the current game. Therefore, in the future market, close attention should be paid to when a substantive turning point in demand will occur.